Craig Corbin from Broadband Universe recently hosted Kevin Mitchell, VP of Alliances & Partners at Alianza, to discuss how full-stack, cloud communications can transform operations for service providers.

Alianza’s Not So Big Secret

Kevin Mitchell: Among many things that are creating opportunities for Alianza is the broadband funding to launch new providers, or have service providers grow into areas that they previously have not served or underserved because the financials didn’t make sense. However, with government funds and grants they’re able to provide that now.

Once broadband (traditionally fiber) is rolled out in rural areas, it’s an opportunity for Alianza to replace plain-old-telephone-system (POTS) lines with a modern home phone or a full-stack UCaaS cloud PBX business offering.

Also, we are in the VoIP 3.0 era with VoIP 1.0 legacy solutions that are more than 15 years old. Many vendors have disappeared or been acquired, or their solutions are no longer innovative, or it’s too complex to add new features or make it easier to operate. As these solutions are on the verge of end-of-life (EOL), it makes no sense to maintain them. Even if CSPs stubbornly want to maintain such solutions, it is very challenging as manufacturers of such platforms no longer exist. This is driving a lot of change as well as opportunities for Alianza, especially since there are so few providers or vendors that are squarely focused on helping service providers. We’ve got 32+ consecutive quarters of revenue growth under our belt now because of these trends.

The Impact of RDOF on Voice

Mitchell: The FCC has made phone service a requirement as part of their CAF Phase II and RDOF regional funding. One of the drivers behind this funding is that the FCC wants modern communications to be available in those areas instead of relying on copper POTS technology that is based on end-of-life switches.

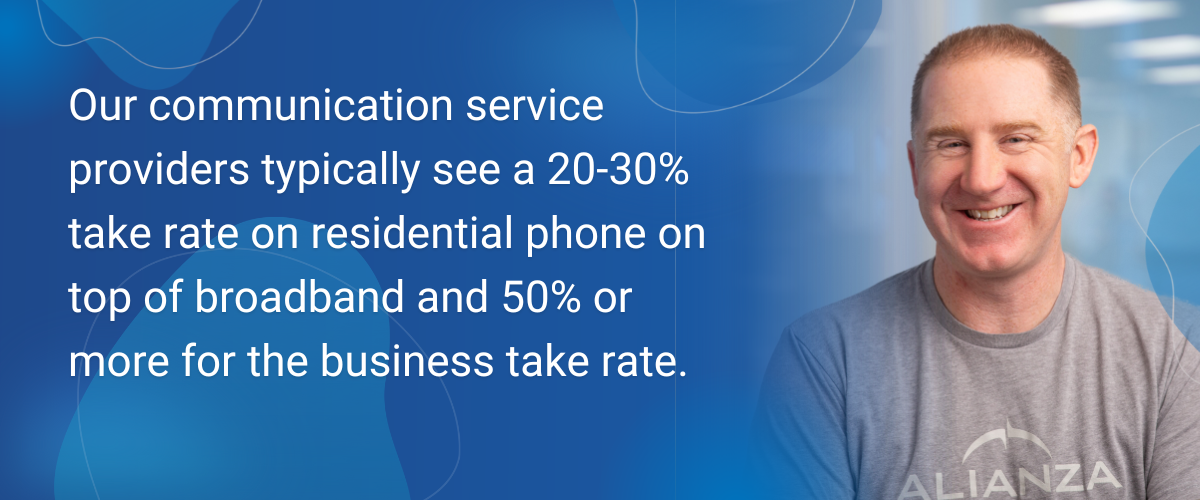

Beside the FCC requirement, it is also a great business decision for service providers to bundle voice with their broadband offerings, especially is they’re serving any business customers. We generally see a 20 to 30 percent take rate on home phone on top of broadband in the residential world and the business take is 50+ percent. That is good margin-rich revenue added on top of the broadband revenue. It also helps the overall broadband take rate and retention rate, because of consumers in the market that want to make a switch and do not want multiple providers. If consumers want to make a broadband switch and currently has a home phone, they will choose a broadband provider that offers both, so they don’t have to manage multiple operators.

RDOF vs BEAD Voice Service Requirements

Mitchell: Unlike RDOF, which is administered by the FCC, BEAD is administered by each state. There is no federal requirement for a phone service, however states may apply a phone service requirement as part of that, and some states have for their other county-based funding that has come out in the past. Even if it’s not a requirement, it makes good business sense for service providers to offer it. We find that 9 out of 10 new operators are going to have a phone service at some point, especially if they have a commercial services division.

We commissioned Independence Research to survey over 500 small and medium business (SMB) telecom decision-makers to get a pulse on the state of cloud communications in the United States. One of the key findings was that SMBs still view voice services as fundamental to doing business. Over half of respondents said they consider voice services essential to their business. This shows that voice is still vitally important in the broadband era. Another important key finding was that SMBs prefer to obtain voice and collaboration services (UCaaS) from a single trusted provider. This highlights why service providers, from a financial perspective should offer phone services, which will help with the ROI on the infrastructure buildout.

COVID Accelerates SMB Cloud Migration

COVID’s stay-at-home mandates caused many SMBs to accelerate their cloud communications plans. Many of the changes brought on by the pandemic will be permanent and will have lasting implications for service providers, including the need to support increased numbers of SMBs that continue to rely on work from home or hybrid-work models post COVID. Cloud communications and collaboration solutions are here to stay. With voice services continuing to play a vital role, for both internal conversations and customer interactions, now is the time for service providers to reexamine their SMB portfolios.

Another solution we brought to market is our Business Text Messaging (BTM) solution, which is a browser-based application that enables businesses to add a new SMS and MMS communications channel using its landline phone number. With features including automated keyword responses, scheduled responses, contact management, and marketing campaigns, SMBs can leverage their phone number for multiple inbound and outbound communications.

Predictions for The Future of RDOF & Rural Broadband Funding

As I mentioned previously, there’s a lot of funding coming, and that funding is going to fund five to ten years’ worth of work in terms of the infrastructure buildouts and getting fiber as close to the customer as possible. If not, it’s going to be connecting to towers that are going to feed very high-speed wireless connectivity options and many of the leading manufacturers are adding those capabilities into their platform.

The Cavell Group predicts that the US cloud communications market is set to grow to over 64 million users by the end of 2025. That’s a 3 times increase from where it was a couple years ago and that’s because of all this fiber and broadband buildout, which is replacing retired or soon-to-be-retired copper POTS solutions.